Kaiser Hit With Record $556M Medicare Fraud Payout — Here’s What It Means for Nurses

Affiliates of Kaiser Permanente have agreed to pay $556 million to resolve federal allegations that they violated the False Claims Act (FCA) by submitting unsupported diagnosis codes on Medicare Advantage records that resulted in higher reimbursements, according to the Department of Justice.

The settlement, announced January 14, 2026, resolves a lawsuit that accused Kaiser of pressuring its physicians to add diagnoses to patient charts after visits, even when those diagnoses had little or no connection to the actual clinical care provided.

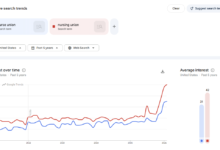

Federal prosecutors alleged that Kaiser engaged in a practice known as risk adjustment upcoding — filing diagnosis codes that made patients appear sicker than they were, resulting in higher monthly payments from Medicare Advantage.

In the complaint consolidated in 2021, the government said staff were pressured to add diagnoses well after patient visits, sometimes months later.

The government alleged that this conduct allowed Kaiser to receive higher reimbursements from Medicare Advantage plans, which pay more for members with more complex health conditions.

At $556 million, this is the largest settlement to date in a Medicare Advantage fraud case.

“More than half of our nation’s Medicare beneficiaries are enrolled in Medicare Advantage plans, and the government expects those who participate in the program to provide truthful and accurate information,” said Assistant Attorney General Brett A. Shumate of the Justice Department’s Civil Division.

“Fraud on Medicare costs the public billions annually, so when a health plan knowingly submits false information to obtain higher payments, everyone — from beneficiaries to taxpayers — loses,” said U.S. Attorney Craig H. Missakian for the Northern District of California.

The settlement grew out of multiple whistleblower complaints filed over several years, which the government later joined. Under the agreement, the whistleblowers—who include at least one physician and a former coding professional—are expected to receive roughly $95 million combined as their share of the recovery.

Kaiser Permanente has not admitted wrongdoing as part of the settlement. The organization issued a statement noting it chose to settle to avoid the delay and uncertainty of prolonged litigation.

Kaiser emphasized that it remains committed to compliance and that the settlement does not involve any finding that patient care was harmed. The company also noted that Medicare Advantage risk adjustment remains a complex and evolving regulatory area, and suggested that some disputed practices occurred in a shifting policy environment.

For bedside nurses and advanced practice nurses, the case underscores how documentation can be influenced by organizational pressure and financial incentives, even when that pressure does not target nursing notes directly. When clinicians are pushed to endorse or support diagnoses that do not accurately reflect a patient’s condition, it conflicts with core nursing values of honesty, advocacy, and patient-centered care.

Nurses working in Medicare Advantage settings may encounter more scrutiny around documentation, internal audits, and coding workflows as regulators and health systems respond to this and other cases. The settlement also reinforces the importance—and potential legal weight—of raising concerns through compliance channels when documentation practices feel inaccurate, coercive, or misaligned with patients’ clinical realities.